By Eric Kinaitis

It is estimated that there are nearly 4.8 million individual businesses that are structured as S-corporations, with an estimated value of nearly $3 trillion in assets. However, due to the nature of the S-corporation structure, the value of these assets are in an illiquid and hard-to-access form.

When a business owner is ready to exit their business, the ability to unlock the trapped wealth within these closely held shares presents an opportunity for the business owner to build a tax-smart charitable legacy. A donor advised fund (DAF) can pave the way to building the legacy that the business owner wants to establish in a way that can help the causes that they want to aid.

One issue to recognize is that some charities may not have the capability nor desire to accept S-corporation shares. An underlying difficulty for many charitable organizations is that they are structured as a non-profit corporation instead of a non-profit asset trust. This non-profit corporation structure may cause the charity to pay Unrelated Business Income Tax (UBIT) on the gift that could reduce the gift’s value by up to 20%, as is the case with American Endowment Foundation(AEF).

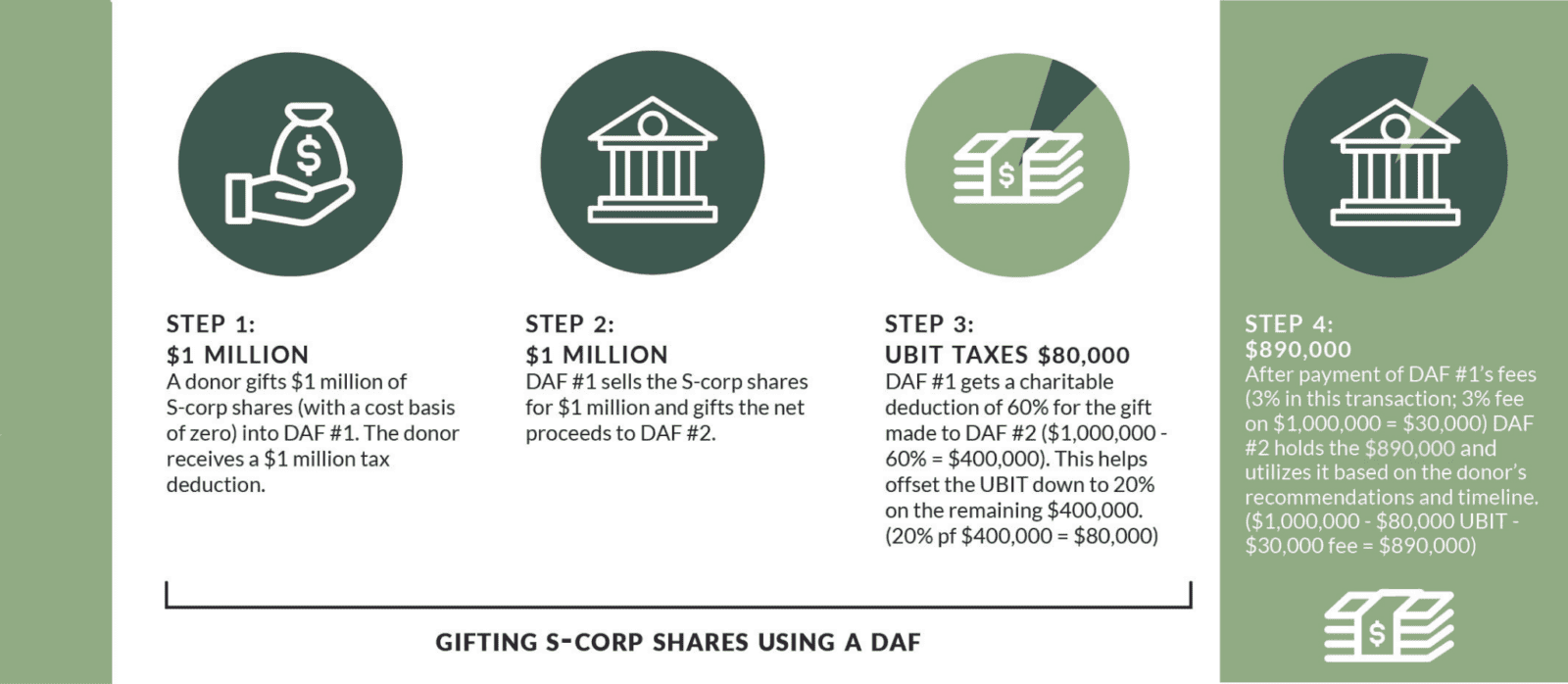

To help our donors who would like to use S-corporation shares for their charitable giving, AEF partners with a third party administrator to accept such gifts, using a two-step DAF solution as illustrated below:

From the illustration above, the third party administrator functions in the role of DAF #1, and AEF in the role of DAF #2. By implementing this two-step DAF approach, the donor would receive an immediate income tax charitable deduction from the donation of their illiquid S-corporation shares, and will be able to retain a larger share of the gift to support their charitable interests. The financial advisor of the donor is able to manage client assets that were not otherwise available while in their illiquid form.

At American Endowment Foundation, we look forward to discussing the creative ways that this two-step donor advised fund process can be used to unlock the wealth in S-corporation shares. Contact us or call at 1-888-660-4508 to learn more about the innovative ways that we can help donors and their trusted advisors create a lasting charitable legacy.