By Laura Malone

While a large part of wealth in the US is tied up in various non-cash assets, often these assets get overlooked when individuals are making charitable gifts. Quite frequently, not gifting all or some of these assets can shortchange both the donor and their favorite charities.

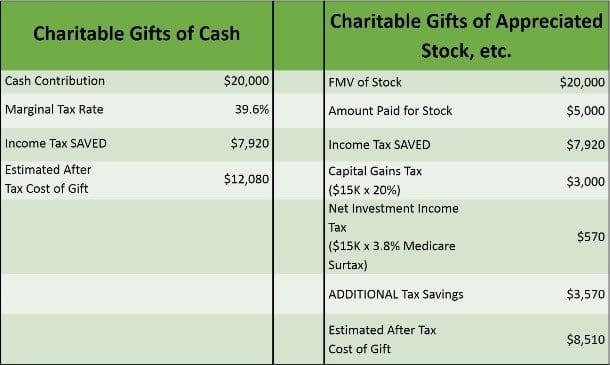

Donating cash is a quick and easy way for someone to benefit their favorite charity. However, donating cash instead of other appreciated non-cash assets creates the least amount of benefit to the donor. Consider the example below of gifting cash versus stock the donor may have owned for more than a year.

Each gift is the same dollar amount and each gift creates a charitable deduction of $7,920 for the donor. However, by donating a stock like Apple that had significant growth in the last decade, the donor can also avoid the capital gains tax and net investment income tax they may pay if they were to normally sell the stock. This can trigger an additional tax savings to the donor of about $3,570 and means that the donor really only “paid” $8,510 for that particular $20,000 gift.

Depending on the donor, this could mean more money back in their own pocket or they can create more charitable impact. For instance, they can take into consideration that greater tax savings to gift $28,400 at roughly the same cost as the $20,000 in cash.

The same concepts can apply to other appreciated assets like mutual funds, real estate or other investments so long as the donor has held these assets for more than one year. Often, donors may use this strategy at larger dollar amounts and combine it with a donor advised fund to “pre-fund” multiple years of giving.

In short, by thinking more strategically about gifting non-cash assets, donors can do more good.

(This article originally appeared in CRAIN’S Cleveland Business, Estate Planning Supplement, November 9, 2015)